how to open tax file in bangladesh

A countrys great source of. As per the requirement stated in the Finance Act 2017 if any person earned more than Tk.

Pin On Offers Ramada Resort Kochi

First you have to click on the Registrar button then you have to register with the User ID Password Security Question Email Address and Mobile Number.

. The following is a step by step guidelines on the individual income tax return filing in Bangladesh. Income Tax BD an Income Tax Consultancy service provider in Bangladesh Since 2011. Any non government organization registered with NGO Affairs bureau.

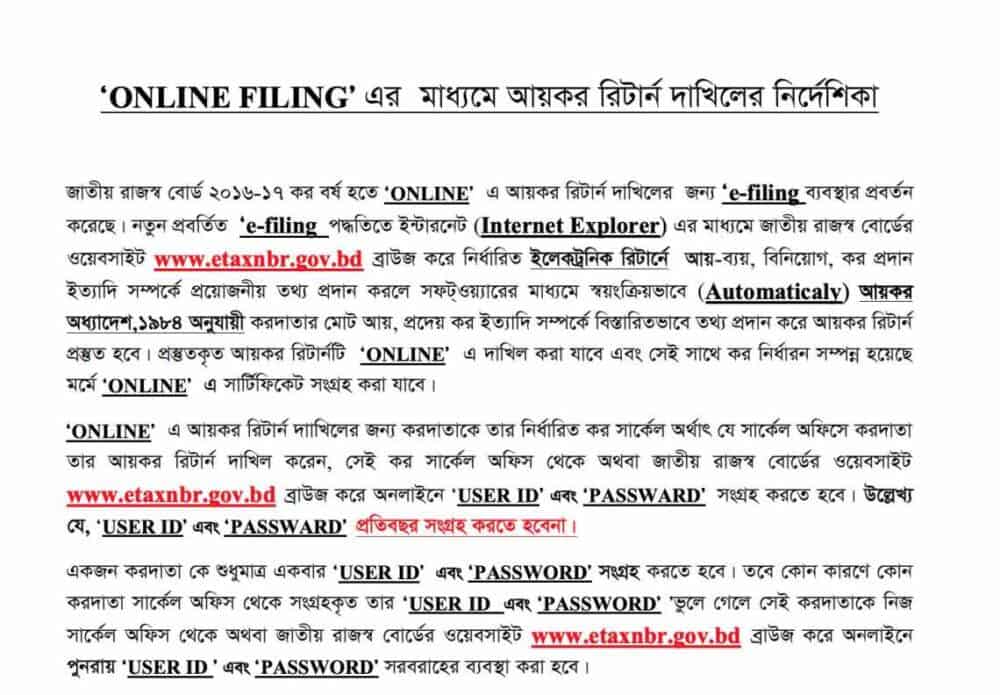

Once you have logged in a list containing all your tax filing obligations is displayed under the Task Overview tab. After assessing the amount of income tax every assessee shall deposit the amount to the govt. From the homepage Taxpayer clicks Register Account tab.

At First Visit the Website httpssecureincometaxgovbdTINHome. An individual must file tax return within 30th. If you are a withholding agent update your source tax deposit.

It has one of the largest In 880 17 11 314156. Create a User ID by proving necessary informations in the Registration form. Configuring Mozilla Firefox and Interner Explorer for Submitting Online Income Tax Return in Bangladesh using Adobe Acrobat Reader DCLatest Adobe Acrobat Re.

Obligation to file tax return. Tax return filing and tax payment relief. Update your tax payment.

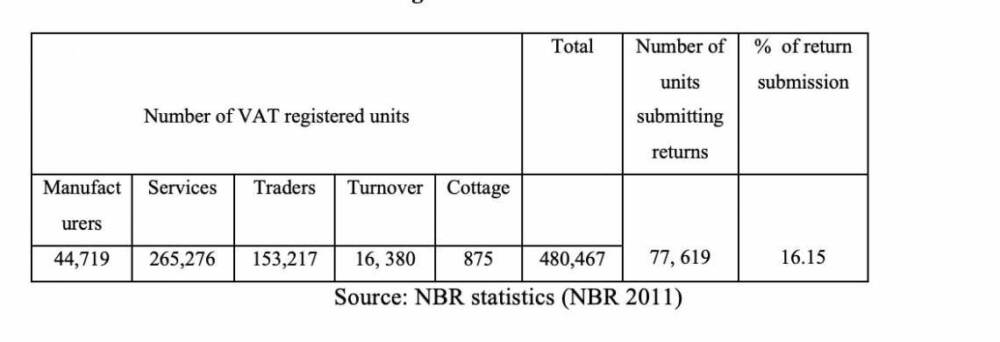

The rates of Tax applicable in Bangladesh are as follows. Value-added tax VAT is levied on the importation of goods and the making of taxable supplies in the course of carrying out a taxable activity. Every individual must submit hisher income tax return to the concerned Deputy Commissioner DC of Taxes from 1 July to 30 November.

Required Document for Submission of TAX RETURN Document Needed for Submission of TAX RETURN. Return-Business Professional income upto 3 Lakh- IT11CHA. Click Filing under Task OR select the Filing tab and click File a New Tax.

The standard rate is 15 percent. A person shall file a return of income to the DCT of the income year. Taxpayer accesses the address httpetaxnbrgovbd.

Primary Information of Assesses. Exchequer by pay order challan treasury or online via wwwnbrepaymentgovbd and submit duly signed and verified return form along with the necessary documents to the tax circle concerned. Tax return filing and tax payment relief measures COVID-19 Bangladesh.

Choose the online account application form and clicks. Exchequer through pay order treasury challan or online via wwwnbrepaymentgovbd and. File your tax return.

You can calculate yo. Turnover Tax applicable to turnover tax payer up to Taka 8 million is 3. The standard rate of VAT in Bangladesh is 15.

In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income. In order to obtain a User ID and password to. For Tax Submission in Bangladesh each assessee shall deposit the amount to the govt after assessing the amount of income tax.

Time limit to submit the return. Register as a taxpayer. The government on 7 May.

Pictures for the first time. How to calculate Online Income Tax Return using Online User ID and Password and process of filing all the interfaces using Mozilla FirefoxInternet Explorer. The National Bureau of Revenue NBR of Bangladesh has fastened the process of registering for E-Tin in Bangladesh.

Time limit to submit the return and supporting documents. 250000 during the income year then that person needs to file. Certificate of tax collected at source Doc Certificate of tax collected at source Pdf Certificate of tax deducted at source Doc Certificate of tax deducted at source Pdf Monthly Statement of Tax Deduction from Salaries Pdf.

A if the total income of the person during the income year exceeds the minimum tax threshold under this. Now people of Bangladesh can open their eTIN account. Our taxation services at FM Consulting International ensure both advantage to the individual and compliance according to Bangladesh taxation policy.

An overview of Individual Income Tax in Bangladesh. Pay your tax online.

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Online Tax Return Application Digitax Launched

What Documents Require With Return Of Income To Nbr In Bangladesh

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

United Insurance Company Ltd Job Circular Apply Unitedinsurance Bd Job Circular Insurance Company Company Job

Online E Tin Registration And Income Tax Return 2021 22

Online E Tin Registration And Income Tax Return 2021 22

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Collect E Tin Certificate From Online In Bd Only 5 Minutes

Nbr To Launch Online Tax Return Filing Service Nov 1 The Daily Star

Tax Evasion And The Role Of The State Actor S In Bangladesh International Journal Of Public Administration Vol 42 No 10

Pdf Taxation Of Bangladesh Kazi Arafat Munna Academia Edu

What Documents Require With Return Of Income To Nbr In Bangladesh

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Government Of The Peoples Republic Of Bangladesh

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat